Eligibility Individuals aged 18. At present there are eight PRS providers which include Affin Hwang AM AIA AmInvest CIMB-Principal Kenanga Investors Manulife AM Public Mutual and RHB AM.

Save For Retirement And Enjoy Tax Relief Too Prs Live

For starters PRS is a voluntary contribution scheme where you can contribute as little or as much as you want.

. Low initial investment Low initial investment additional investment amount at RM100 RM50 respectively. The Philippines Thailand Malaysia Singapore Indonesia India Vietnam and Cambodia are some countries where one can find a safe retirement haven friendly people. The PRS was launched in July 2012 with the objective of offering Malaysian employees and the self-employed an additional avenue to save for their retirement.

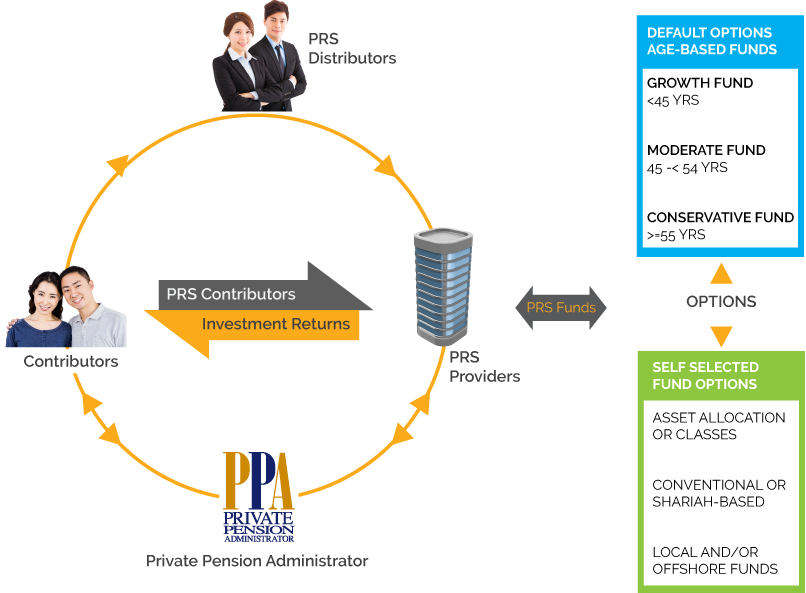

The Private Retirement Schemes are offered by PRS Providers who are approved by the Securities Commission Malaysia. Private Retirement Schemes. NEW CFP Certification Program Structure for 2015 December 4.

Hello all Im considering to start a PRS account with CIMB. It is designed to complement the. Private Retirement Scheme PRS is an investment scheme that facilitates the accumulation of retirement savings through voluntary contributions.

Posted by 3 years ago. PRS is a voluntary long-term investment and saving scheme designed to help you save adequately for retirement. This could be as much as RM840 per year depending on your tax bracket.

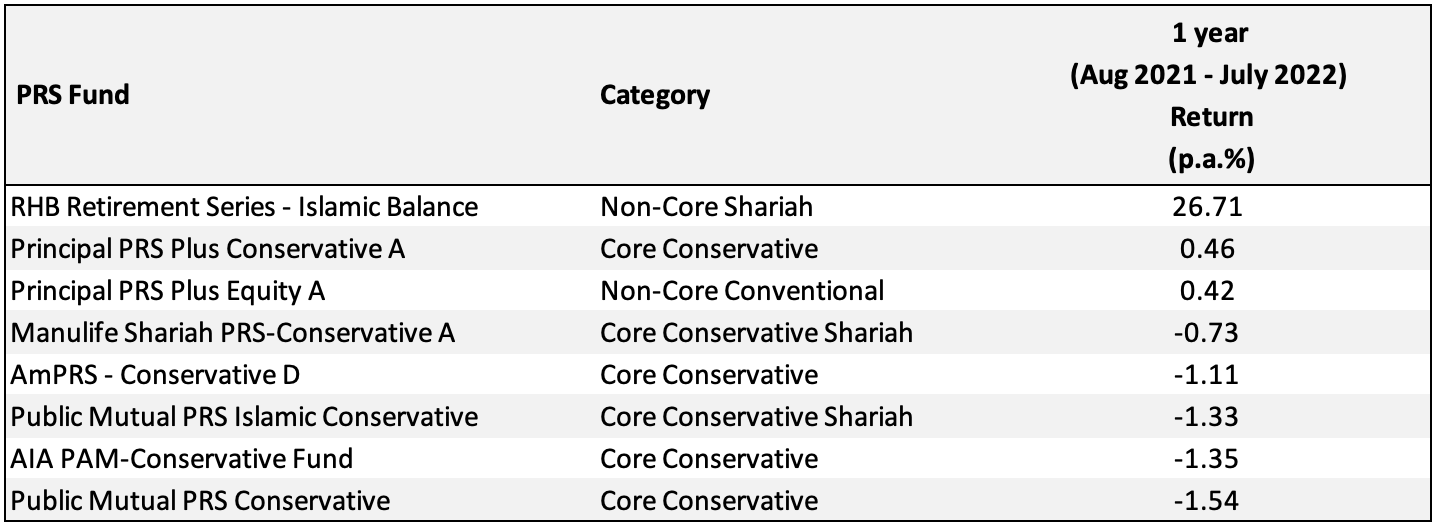

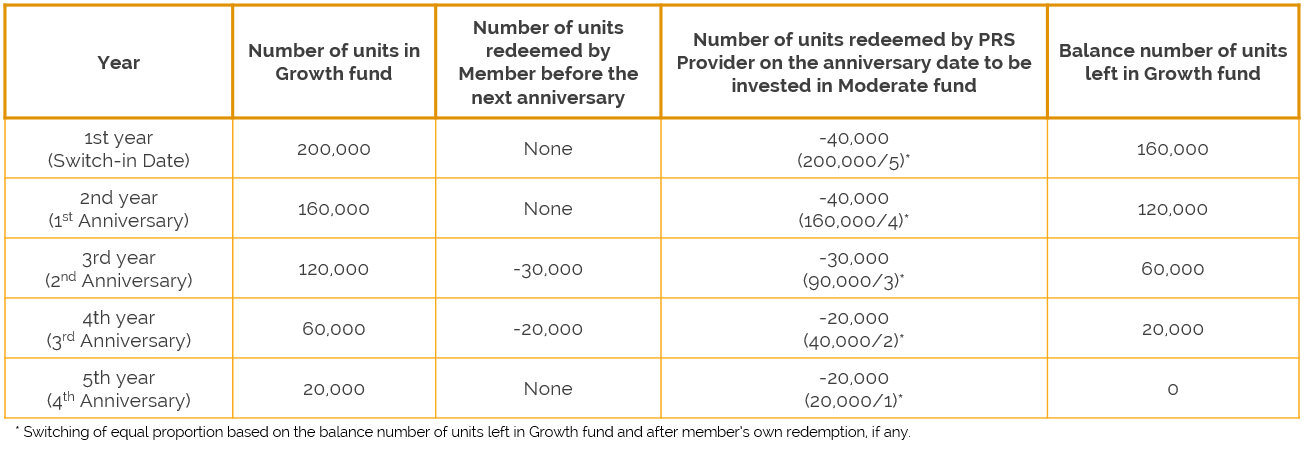

Bumiputera Dealer Representatives Education Fund BDREF November 10 2014. Core Funds Each provider must offer 3 core funds as a default option for PRS. For contributions into the PRS and deferred annuities effective from years of assessment 2012 to.

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. How are your experiences with your PRS. There are two broad categories of retirement funds Core Funds and Non-Core Funds.

A voluntary contribution scheme A vehicle to accumulate savings for retirement Complements contributions made to Employees Provident. For public employees there is the Kumpulan Wang Persaraan Diperbadankan or KWAP Malaysia which focuses on managing retirement and pension funds for civil servants. What is Private Retirement Scheme PRS.

Invest with an affordable sales charge at 15. Secondly PRS is privately run by financial institutions with no. It also offers an opportunity for.

Fast facts about the Private Retirement Scheme PRS A voluntary scheme for all individuals who are 18 years old and above A way to boost your total retirement. PRS offers the safest most flexible and regulated retirement. The eight 8 available PRS Providers are.

PRS seek to enhance choices available for.

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Prs Tax Relief Extended Until 2025 Will Benefit Retirement Savers Prs Live

Prs For Self Employed Private Pension Administrator Malaysia Ppa

Private Retirement Scheme Principal Asset Management

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube In 2022 Investing Financial Literacy Fund

5 Difference Between Elss Vs Ppf Vs Nsc Vs Tax Saving Fixed Deposit Nri Saving And Investment Tips Savings And Investment Income Tax Tax Free Savings

Prs Funds Information Private Pension Administrator Malaysia Ppa

Diversify Your Retirement Nest Egg

Structure Of Prs Private Pension Administrator Malaysia Ppa

Structure Of Prs Private Pension Administrator Malaysia Ppa

Structure Of Prs Private Pension Administrator Malaysia Ppa

Aminvest Private Retirement Scheme

Structure Of Prs Private Pension Administrator Malaysia Ppa

What S The Difference Of Private Retirement Scheme And Deferred Annuity Plan Kclau Com

Which Prs Funds To Invest In 2020 2021 Mypf My Investing Financial Literacy Fund

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube